[Bitop Review] Vanguard Effect Drives 6% Bitcoin Surge as BTC Reclaims $90,000 Mark

2025年12月03日发布

U.S. stocks closed higher on Tuesday as market sentiment recovered. Bitcoin rallied strongly after the U.S. market opened, rising from $87K to touch $92K—a gain of over 6%—pushing the total crypto market capitalization back to $3.11 trillion. Bloomberg ETF analyst Eric Balchunas termed this the "Vanguard Effect," noting that asset management giant Vanguard, after years of rejecting cryptocurrencies, announced that starting this week, it would allow clients to trade ETFs and mutual funds holding crypto assets such as Bitcoin, Ethereum, Solana, and XRP on its platform.

Market Sentiment Recovers, Capital Flows Back into Tech Stocks

U.S. stocks closed higher on Tuesday as market confidence warmed, with capital flowing back into technology and growth stocks.

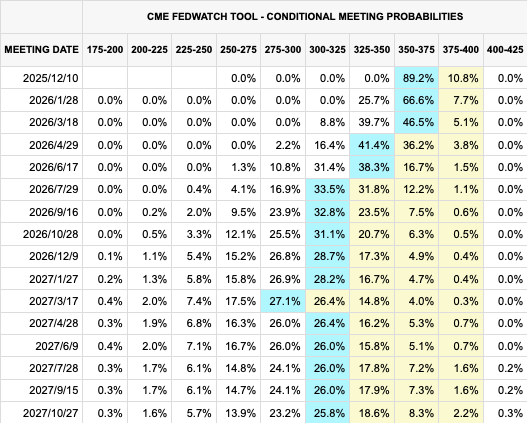

Traders are currently optimistic that the Federal Reserve will lower its target interest rate at next week's policy meeting. According to the CME FedWatch Tool, market expectations for a rate cut at the upcoming meeting are approximately 89%, significantly higher than the probability forecast in mid-November.

U.S. President Trump stated that he plans to announce his choice for Federal Reserve Chair in early 2026. In response, traders in the U.S. futures market are projecting various policy paths and are generally bullish on further rate cuts next year.

Vanguard Effect Drives 6% Bitcoin Surge

Yesterday, Bitcoin rallied strongly after the U.S. stock market opened, surging from $87K to $92K—an increase of over 6%—bringing the total crypto market capitalization back to $3.11 trillion.

Bloomberg ETF analyst Eric Balchunas called this the "Vanguard Effect." After years of shunning cryptocurrencies, asset manager Vanguard announced that starting this week, it is opening its platform for clients to trade ETFs and mutual funds containing crypto assets like Bitcoin, Ethereum, Solana, and XRP. Bitcoin surged 6% on the first trading day following the lifting of the ban. Bitcoin ETF trading volume reached $1 billion within the first 30 minutes of trading.

Balchunas noted that while this was completely outside his expectations for 2025, he believes that even some of the most conservative investors like to add a little hot sauce to their portfolio.

Disclaimer: None of the information contained here constitutes an offer (or solicitation of an offer) to buy or sell any currency, product or financial instrument, to make any investment, or to participate in any particular trading strategy.