[Bitop Review] BOJ Rate Hike Hints Spark Yen Carry Trade Unwind Speculation; Bitcoin Plunges to $83K

2025年12月02日发布

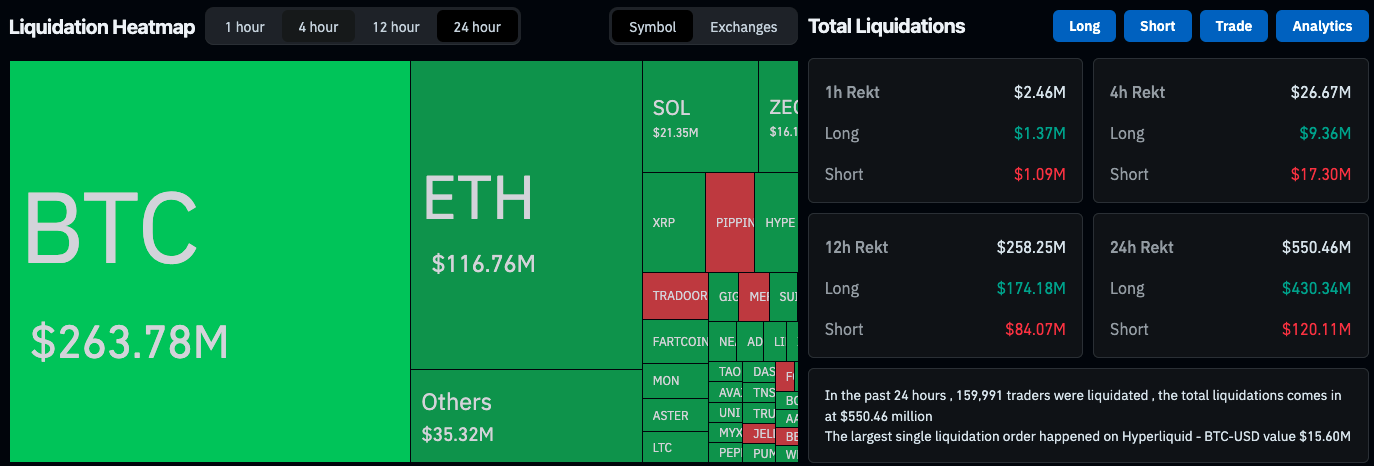

US stocks got off to a rough start in December. Influenced by potential interest rate hikes by the Bank of Japan (BOJ), which triggered speculation about the unwinding of Yen carry trades, the crypto market took the lead in sliding. Bitcoin fell all the way from the $90,000 mark during yesterday's Asian session, reaching a low just above $83,000 in the evening. Approximately $550 million in positions were liquidated over a 24-hour period.

PMI Records Largest Drop in Four Months; High Probability of Fed Rate Cut Next Week

Data released on Monday showed that, dragged down by weak orders, the US ISM Manufacturing PMI for November fell to 48.2, marking the largest decline in four months. In addition to the inflation data to be released on Friday, other relevant economic data this week includes the November ADP private sector employment report and the preliminary December Consumer Confidence Index.

Ulrike Hoffmann-Burchardi of UBS Global Wealth Management stated that historically, the stock market performs best when the economy is not in recession and the Federal Reserve is cutting rates. Recent data suggests it is more likely that the Fed will cut rates by 25 basis points (one quarter-point).

She also noted that the current period of weakness in the US economy may be temporary, and global economic growth is expected to accelerate in 2026.

BOJ Rate Hike Sparks Yen Carry Trade Unwind Speculation? Bitcoin Retraces to $83K with $550 Million Liquidated Network-Wide

Bitcoin has been falling steadily from the $90,000 mark since yesterday's Asian session, reaching a low above $83,000 overnight. Influenced by the potential for a Bank of Japan rate hike—which sparked speculation about an unwinding of the yen carry trade—the crypto market led the decline, with approximately $550 million in positions liquidated within 24 hours.

Strategy Establishes $1.4 Billion Reserve to Alleviate Concerns Over Bitcoin Sales

Strategy (formerly MicroStrategy), the pioneer of the Bitcoin reserve strategy, announced the establishment of a $1.44 billion reserve fund to pay future dividends and interest, aiming to alleviate concerns. Previously, CEO Phong Le admitted that if the company's mNAV remains below 1 for an extended period and financing channels dry up, selling a portion of its BTC holdings would become the last resort to maintain the company's finances.

U.S. spot Bitcoin ETFs saw inflows of only $70 million last week, following approximately $4.6 billion in outflows over the past month. The majority of the outflow pressure (about $2.3 billion) came from BlackRock's IBIT, which has experienced investor withdrawals for five consecutive weeks—the longest streak since its inception in January 2024. However, company executives stated that given the high liquidity of ETFs, this situation is normal. They also noted that demand has been strong this year, with IBIT's assets under management nearly reaching $100 billion at the peak of market demand.

Disclaimer: None of the information contained here constitutes an offer (or solicitation of an offer) to buy or sell any currency, product or financial instrument, to make any investment, or to participate in any particular trading strategy.