[Bitop Review] Crypto Analysis: DOT, DYDX, WLD

2025年07月08日发布

DOT

After recently breaking below a large trading range (purple parallel channel), DOT found support around $3. The price has slowly recovered, gradually forming a flag pattern (light blue parallel channel), indicating a potential continuation of the trend. The price faced resistance again at approximately $3.65, roughly aligning with the Fibonacci 0.5 level and prior pressure. Currently, the price is at the lower edge of the flag pattern. If it breaks below, traders can consider entering a short position, or wait for a price retracement to a better entry point for a high-level short. Entry points between $3.5 and $3.6 are favorable. Take-profit levels can be set at $3, $2.65, and $2.2. Stop-loss should be placed above the resistance at $3.67.

Reference Levels:

Direction: Short

Entry: $3.5 - $3.6

Take-Profit: $3 / $2.65 / $2.2

Stop-Loss: $3.67

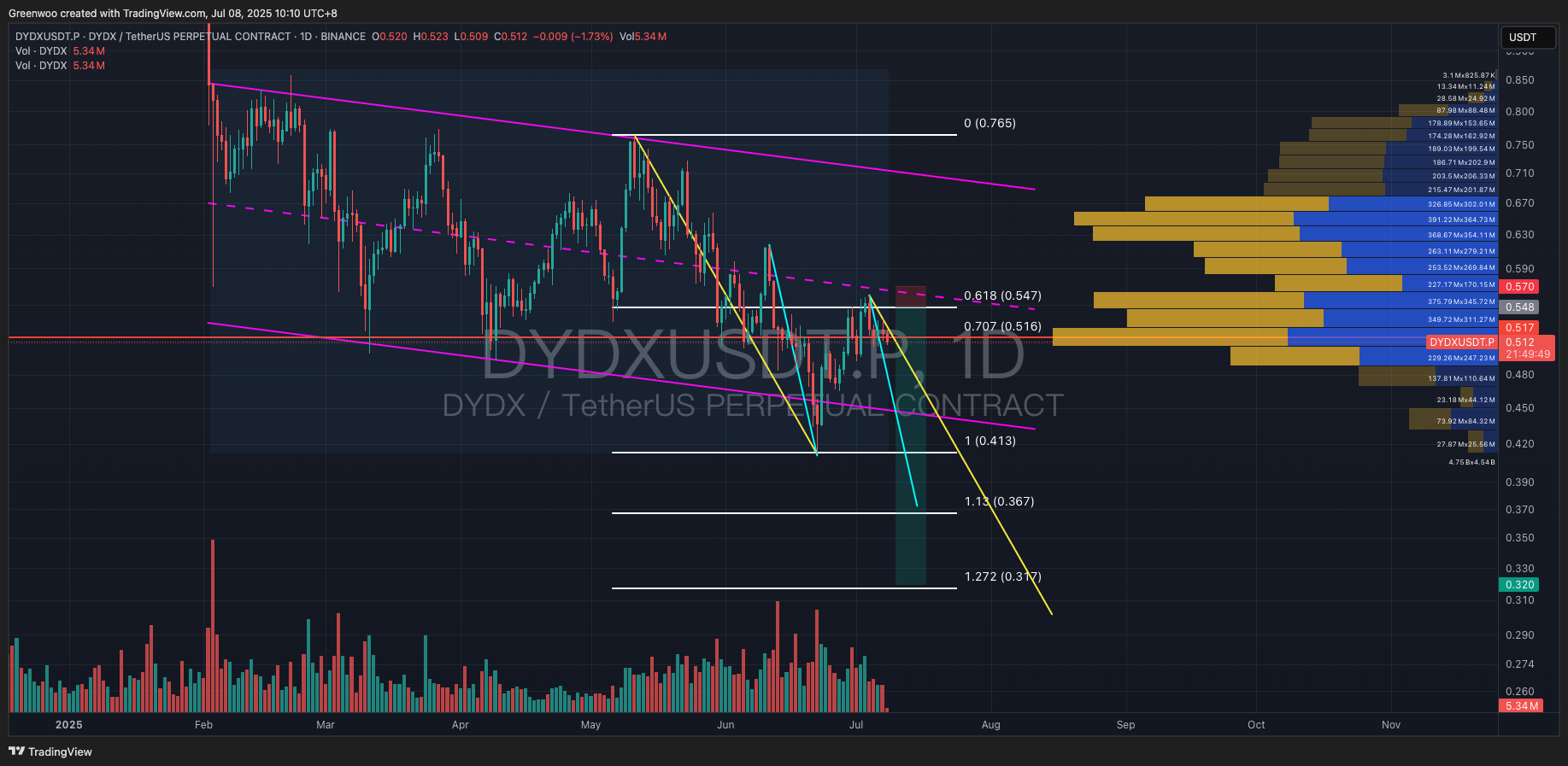

DYDX

Since early February, DYDX has been in a gradual decline, forming a large descending channel (purple parallel channel) over nearly six months. Recently, the price broke below the channel and found support at $0.41, rebounding afterward. The price rose slowly but faced resistance again at $0.56, a level that coincides with a high-volume trading zone, the Fibonacci 0.618 level, and slightly below the channel’s midpoint, indicating strong overhead resistance and a potential continuation of the bearish trend. As of writing, the price is at $0.515, roughly at the Fibonacci 0.707 level. Aggressive traders may enter a short position at the current market price, or wait for a retracement to a better entry point. Entry levels between $0.54 and $0.55 are ideal. Take-profit levels can be set at $0.41, $0.37, and $0.32. Stop-loss should be placed above the channel’s midpoint, around $0.57.

Reference Levels:

Direction: Short

Entry: $0.515 (market price) / $0.54 - $0.55

Take-Profit: $0.41 / $0.37 / $0.32

Stop-Loss: $0.57

WLD

After breaking below its trendline, WLD entered a short-term consolidation, gradually forming a flag pattern, a signal of potential trend continuation. Although the price has not yet decisively broken below the flag, traders can set up a short position near the upper edge of the flag for a favorable entry, or wait for a confirmed break below the flag to enter a short. For a bearish outlook, traders can place a short order around $0.95, slightly below the flag’s upper edge. Take-profit levels can be set at $0.77, $0.65, $0.6, and $0.5. Stop-loss should be placed above the previous high at $0.984.

Reference Levels:

Direction: Short

Entry: $0.95

Take-Profit: $0.77 / $0.65 / $0.6 / $0.5

Stop-Loss: $0.99

Disclaimer: None of the information contained here constitutes an offer (or solicitation of an offer) to buy or sell any currency, product or financial instrument, to make any investment, or to participate in any particular trading strategy.