[Bitop Review] Bitcoin Falls Below $100,000, Ethereum Drops Below $3,600, Powell: The Federal Reserve is Not Allowed to Hold Bitcoin

2024年12月19日发布

Following the Federal Reserve's interest rate decision announced at 3 a.m. today (19th), despite a rate cut of 25 basis points bringing the benchmark rate to 4.25% to 4.5%, Bitcoin entered a downward trend due to reduced expectations for rate cuts next year. BTC plunged from a high of $104,800 to a low of $98,802, with an intraday drop of 5.7%. Before the deadline, it slightly recovered to $100,700, down 4.16% over the last 24 hours.

Another possible reason for the selling pressure was Federal Reserve Chairman Powell stating at the post-FOMC press conference, "We are not allowed to hold Bitcoin." Regarding the legal issues of holding Bitcoin, Powell added, "This is something for Congress to consider, but we have no intention of seeking to change the law." Powell's statement was correct; currently, the Federal Reserve is not allowed to hold BTC under existing regulations.

Ethereum Dips to $3,541

Similarly, Ethereum also saw a decline after the rate decision, dropping from a high of $3,907 to as low as $3,541, with an intraday drop of 9.2%. Before the deadline, it was trading at $3,656, down 5.5% over the last 24 hours.

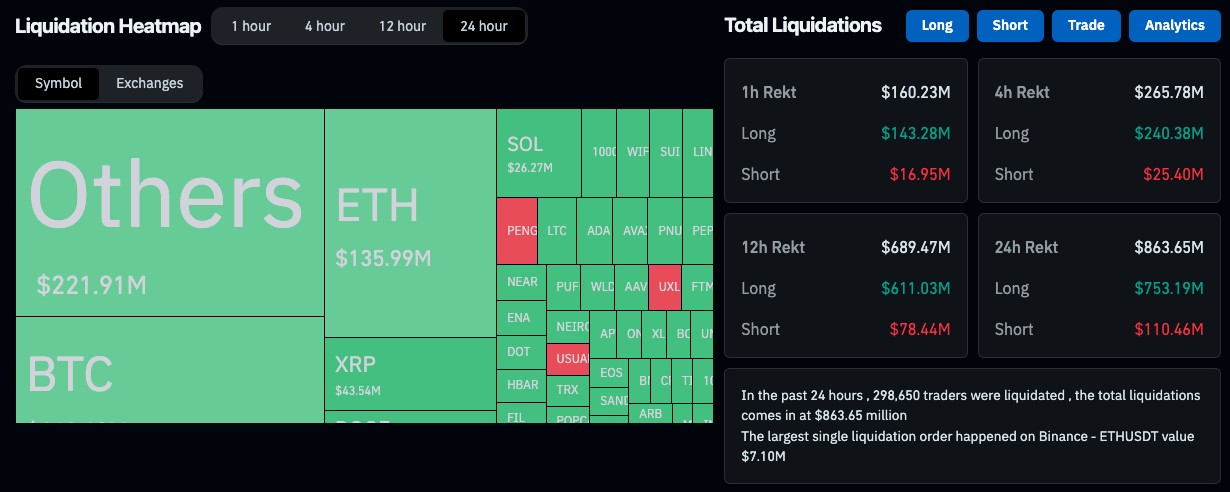

Liquidations of $863 Million in the Last 24 Hours

According to Coinglass data, the total liquidations across the crypto market in the last 24 hours reached $863 million, with long positions accounting for $753 million of the losses, while short positions led to about $110 million in liquidations, affecting nearly 300,000 traders.

Disclaimer: None of the information contained here constitutes an offer (or solicitation of an offer) to buy or sell any currency, product or financial instrument, to make any investment, or to participate in any particular trading strategy.