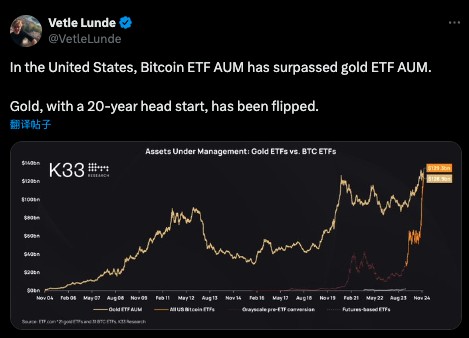

[Bitop Review] Bitcoin Hits New High of 108K, U.S. Bitcoin ETF Officially Surpasses Gold ETF, Overturning Gold's 20-Year Dominance

2024年12月18日发布

On December 17, while most U.S. stock indices saw slight declines, Bitcoin continued to rise into the night, reaching a historic high of $108,353 around 10:30 PM. By the time this article was written, it had slightly fallen back to $105,436, with a 0.82% drop over the last 24 hours.

Vetle Lunde, Director at the crypto analysis firm K33 Research, posted on the social platform X yesterday that U.S. spot Bitcoin ETFs have surpassed U.S. gold ETFs in asset size within less than a year of trading:

What are the U.S. ETFs backed by physical assets?

In the U.S. stock market, the number of ETFs backed by physical assets is relatively limited, primarily focusing on precious metals like gold and silver. Other commodities like oil and agricultural products are mostly invested through futures contracts. Here are some common ETFs backed by physical assets:

1. Gold ETFs

There are approximately 5 to 10 gold-backed ETFs, though the exact number can fluctuate due to new launches or delistings.

2. Silver ETFs

3. Other Physical Precious Metal ETFs

Apart from gold and silver, there are a few ETFs backed by physical platinum (PPLT) and palladium (PALL).

In summary, in the U.S. market, ETFs truly backed by physical assets are mainly in the precious metals sector. The introduction of Bitcoin spot ETFs represents a significant innovation.

Bitcoin Breaks 108K to Set New High

Bitcoin continued its upward trend on the night of December 17, reaching a new historic high of $108,353 around 10:30 PM. It has since slightly declined to $105,436, with a 0.82% decrease over the last 24 hours.

QCP: Hard to Find Reasons to Be Bearish on Bitcoin

QCP Broadcast released a report on its official Telegram channel yesterday, stating it's challenging to find reasons to be bearish on Bitcoin. This sentiment comes as the U.S. Financial Accounting Standards Board (FASB) has enacted its first accounting standard for cryptocurrencies, allowing companies to record their digital assets at fair market value. This could encourage U.S. companies to embrace and adopt digital assets more actively, thereby driving market growth with an optimistic outlook.

Disclaimer: None of the information contained here constitutes an offer (or solicitation of an offer) to buy or sell any currency, product or financial instrument, to make any investment, or to participate in any particular trading strategy.